WorkFar Robotics Mass Produces Humanoid Robots without Venture Capital

Read Now on: Yahoo! Finance

As robotics investing climbs out of its 2023 slump, humanoid robotics pioneer WorkFar — which has not received any funding from venture capital — is ready to produce at the level of competitors already receiving billions of investment dollars.

Santa Clara, CA, November 27, 2024 — There’s nothing quite like the tenacity of a new company with a unique value proposition that directly addresses the needs of its target customer base. WorkFar Robotics, a business specializing in commercial humanoid service robots for industrial applications, has yet to get on the radar of today’s venture capitalists — but that hasn’t stopped them from reaching the mass-producing stage.

Many companies, particularly those in the robotics industry, are reliant on venture capital, and they can go for years — or even a decade — without turning a profit. Building a cash-flowing robotics company with no investment aside from hard work, creativity, and business acumen is a feat rarely accomplished. Yet WorkFar has managed to achieve the same level of progress as competitors receiving $100 million to over $1 billion in investment funding.

WorkFar’s Business Model: An Autonomous, Remote-operatable Robot for $0 down

WorkFar’s offering is unique in the world of industrial robotics. The industry’s most common business model is to sell an expensive product to a manufacturer and possibly provide some integration services. For companies unable to afford the high price tag, certain robotics manufacturers offer a subscription-based “Robot-as-a-Service.” WorkFar takes this a step further by allowing clients to lease both a robot and a trained, remote operator on a monthly basis without a down payment.

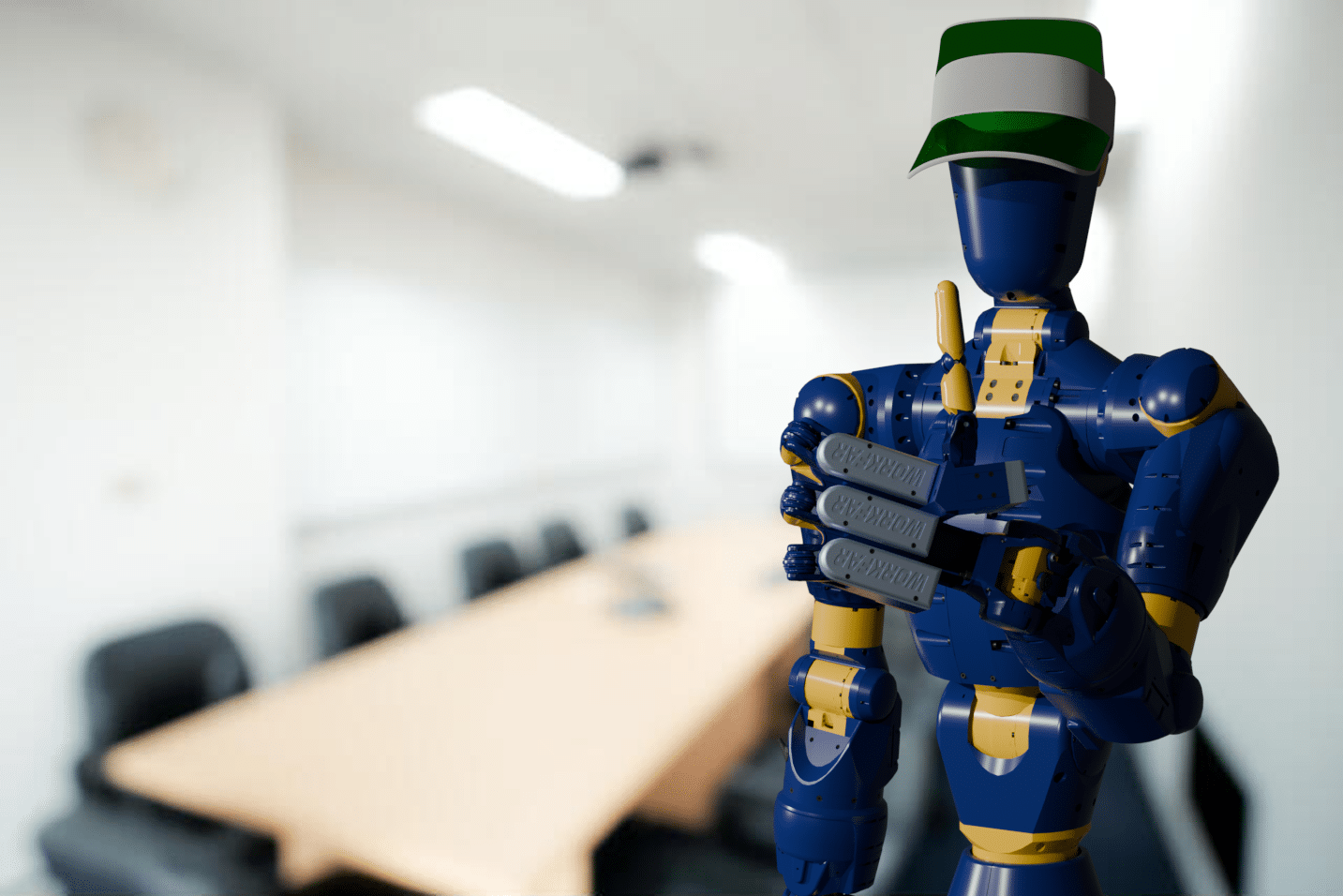

The combination of sophisticated humanoid robot, AI-enhanced programming, and an optional human operator constitutes a turnkey solution for warehouses and manufacturers dealing with aggravating challenges like long-lasting labor shortages, concerns around worker safety and burnout, and issues with efficiency and consistency. Since the optional teleoperator is remote-based, WorkFar can leverage the global workforce to support its customers.

The WorkFar “Syntro” robot uses virtual reality eye tracking and AI algorithms to target and grasp objects at the operator’s direction, and the operator gets feedback on object pick-up through haptic gloves. The robot’s “core logic” is human intelligence, which — despite rapid advances in AI — still can’t be beat.

WorkFar’s Manufacturing Expertise goes back Decades

Although the ‘Syntro’ robot is brand-new, WorkFar’s US based manufacturing facility has over 40 years of experience producing plastic and metal parts for industrial machinery and consumer products. This expertise is now being leveraged to mass produce humanoid robot in-house — an arrangement that cuts out the middleman and leads to more efficient operations. With supply chain issues wreaking havoc on robotics companies’ operations for the past several years, this is a major advantage.

Robotics Investing dipped in 2023, but it’s Coming Back strong with AI and Humanoid Technology

Investment in the robotics industry hit a five-year low last year, particularly in the area of autonomous vehicles (AVs). This was partially a result of a widespread market correction within venture capital investing, but the legislative concerns and negative press surrounding AVs didn’t help. The slump was temporary, however, and robotics venture capital is starting to rise again rapidly, with vertical-specific robotics companies focusing on logistics, security, and medical applications leading the way.

One thing that’s making robotics investing much more appealing is the awe-inspiring takeoff in artificial intelligence capabilities. AI models give robots the capacity to execute complex tasks like grasping unpredictably shaped objects much more smoothly and accurately. Even better, AI allows the robots to learn from each effort, rapidly increasing their accuracy and efficiency over time. Robot vision will gain clarity with improved object detection and image segmentation — essential tools for interacting “intuitively” with the environment.

With a design meant to evoke their maker, humanoid robots are poised to reap the greatest benefits from this rapid growth in AI. They show promise across multiple industries, ranging from manufacturing to healthcare to personal assistance. Once AI’s transformative capabilities became apparent, projections for the humanoid robot market ten years from now shot up from just $6 billion to almost $200 billion — or in some estimates, well over $24 trillion.

Sheer Business Acumen has propelled WorkFar to the point of Mass Production

Although the robotics investment outlook is getting brighter, the recent dip has prompted investors to be more discerning and focus on areas where robotic solutions can make important strides right now. Venture capitalists have seen plenty of technology demos that turn heads; now it’s time to back these up with solid business plans that show real returns on investment. With its robot-as-a-service offering at $0 down payment, this is WorkFar’s strong suit.

Even with rapid AI advances, this model will always benefit from the authority and decision-making power of human intelligence. This is central to WorkFar’s vision: a human-robot team that will unleash a new era of productivity, bringing collaborative efficiency to factories and facilities worldwide. This innovative solution takes into account what other solutions overlook: the fact that true productivity depends on human decision-making and robotic efficiency being intertwined, not isolated.

This vision is what has enabled WorkFar to grow on its own revenue in an industry that usually requires millions or even billions of dollars in venture capital. No longer a startup, this company has now pushed into a higher corporate level of investment based on business acumen alone. With a market-ready product that can be manufactured in WorkFar’s own factory, the humanoid robotics pioneer is stronger because it does not rely on venture capital.